If investing in real estate was easy everyone would do it. In a perfect world you would begin your career with surplus capital, unlimited leads and a full team at your disposal. The reality is that most investors aren’t afforded these advantages. Almost every investor has at least one major issue they are forced to deal with. Some are strapped for cash, others are short on time and some have past credit issues. While these can be a problem they shouldn’t prevent you from getting started.

Many investors have had past issues on their credit report. Instead of waiting for credit repair companies to work their magic, you can get the ball rolling by thinking outside the box. Closing a deal with a partner or a hard money lender can give you the push you need to grow your portfolio without having to wait. Here are five things you can do if you have poor credit and want to start investing.

Partnership-

There are plenty of ways to get started in real estate with poor credit. The first thing you can do is find an investing partner. Instead of lamenting the fact that your credit is poor, you should go to local investment club and networking meetings. These meetings are proverbial goldmines to find like minded people in your area. Every meeting is an opportunity to connect with someone that may be willing to form a partnership. Of course, you should never blindly dive into a partnership, but if you have shared goals, morals and ethics you may be a good fit. It is not hyperbole to say that the right partner can instantly transform your business for the better. Not only can it help get started, they can be a way to generate income on deals you normally would have no chance at. Right now, there are dozens of people in every market looking to form a partnership. Don’t sit on your hands and wait for them to come to you.

Hard Money Lender-

If you are having trouble finding the right person to partner with you should explore a hard money option. A hard money lender is a lender that does not follow traditional lending guidelines. Instead of strict credit score minimums they may look more at personal collateral or potential equity in a deal. This is magnified if your poor credit was caused by an isolated incident or some other justified excuse. Not only will hard money lenders provide capital to make an offer they typically will provide the cost of repair capital as well. For this you will pay higher fees and increased interest rates, but you will have an opportunity to start making offers and building your pipeline. Even if your credit was pristine, it is a good idea to align yourself with a hard money lender. Using hard money on certain deals just makes more sense.

Private Money Lender-

Right now, without even realizing it you probably know at least a half dozen people who have money and want to invest in real estate. These are your friends, family, co-workers and personal acquaintances that you have an established relationship with. Start by sending them an email or message on social media explaining that you are involved in real estate and are looking for a financial partner. There is a good chance that you will get multiple responses. Instead of working with a hard money lender who will charge fees and points, a private money lendersimply wants a return on their investment. Their money is probably earning a low return in a savings account and they want to really put it to work. You will have to iron out the details and working with friends and family does have some drawbacks, but it can help you get started.

Wholesale-

There is a way to get started without having to rely on other people. Generally speaking in real estate, whoever has the deal controls the transaction. Instead of waiting on capital you can go out and find deals to wholesale. Wholesaling is essentially getting a seller to agree to a contract price and then delivering the contract to an end investor. They would take the deal over, pay you a fee for your service, and you would step out of the way. You won’t get rich on an individual wholesale deal, but you can definitely generate income with them. The key is to find homeowners who are motivated to see and have a need for a quick closing. Driving for dollars, looking at delinquent tax lists and reaching out to distressed landlords are all great ways to find potential wholesale deals, even if your credit is poor.

Start Repairing Credit-

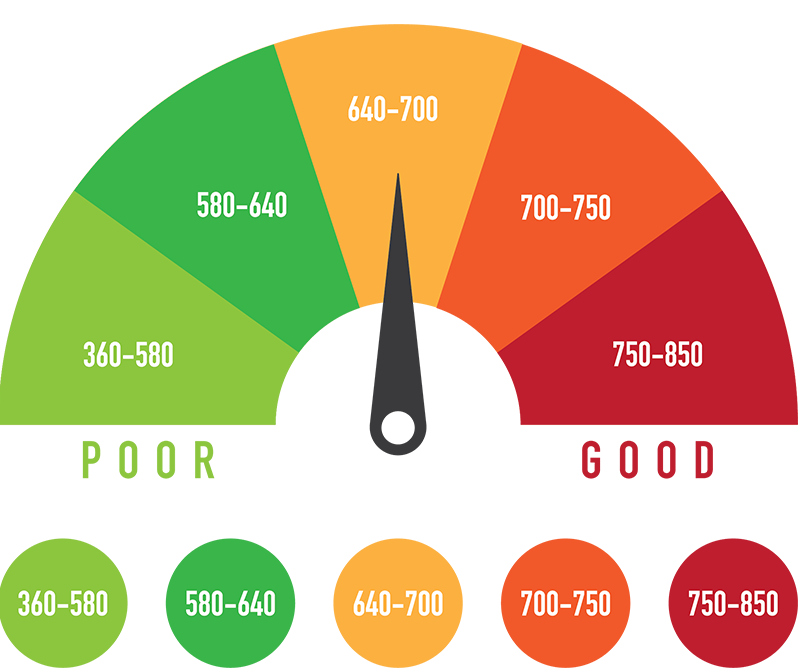

Unless you have had a bankruptcy, foreclosure or significant mortgage lates fixing your credit is probably easier than you think. If the score dropped due to a party erroneously reporting something or a problem with your last name, there are plenty of companies that can help. Your credit may not be fixed overnight, but it won’t take years either. The earlier you can start repairing your credit the quicker things will start to change. Sometimes simply transferring funds and removing a balance can give your credit a 20-point boost. Whatever the problem is, start working on repairing your credit now.

Poor credit should never restrict you from building your portfolio. There are too much options available, regardless of your past credit history.

Source: Than Merrill, “Don’t Let Poor Credit Stop You from Investing in Real Estate

“